Share this article

The best risk management software for 2025

Accelerating security solutions for small businesses Tagore offers strategic services to small businesses. | A partnership that can scale Tagore prioritized finding a managed compliance partner with an established product, dedicated support team, and rapid release rate. | Standing out from competitors Tagore's partnership with Vanta enhances its strategic focus and deepens client value, creating differentiation in a competitive market. |

For many organizations, risk management is still stuck in the past—reliant on spreadsheets, manual reviews, and static registers that go stale shortly after they’re created. Without clear ownership or automation, treatment plans linger, and accountability slips. Risks remain fragmented across departments, disconnected from business impact and board visibility.

At the same time, emerging threats are evolving faster than ever. Cloud complexity, third-party dependencies, and AI adoption are reshaping risk exposure, while most teams face flat budgets and limited headcount. These challenges create reactive programs that struggle to keep pace.

Modern risk management software changes that. By unifying data, automating detection, and driving real-time visibility across the business, these platforms help organizations move from static reporting to continuous, proactive resilience.

The state of risk management software in 2025

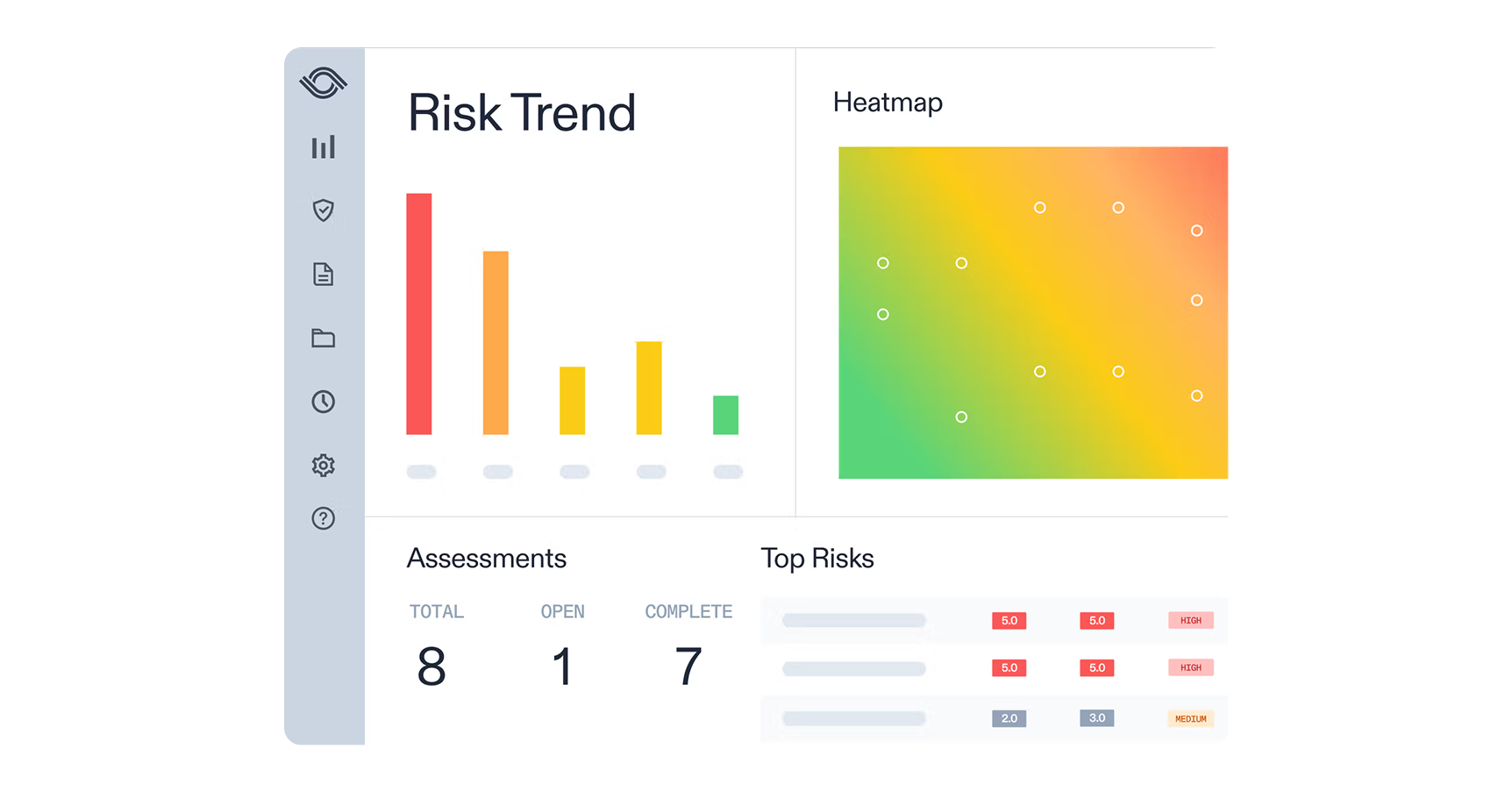

Risk management software helps organizations identify, assess, and mitigate threats to their operations, reputation, and compliance posture. The right platform transforms risk from a point-in-time exercise into a continuous, connected discipline—driving visibility, accountability, and resilience across the business.

According to Vanta’s State of Trust Report, a majority (55%) of teams experience weekly threat activity, and nearly 4 in 5 encounter a threat monthly. Traditional, manual approaches can’t keep up with the pace of risk that modern businesses face tdoay—leading to blind spots, stale data, and reactive management.

Key drivers shaping the risk management landscape:

- From static to continuous monitoring: Traditional, spreadsheet-based approaches can’t keep up with the pace of modern business. Organizations are replacing quarterly assessments with live, automated monitoring that detects issues as they emerge.

- Cross-functional ownership: Risk is no longer confined to security or compliance. Finance, operations, and vendor management all play a role, pushing demand for tools that unify data and decisions across departments.

- AI, cloud, and third-party acceleration: As companies adopt AI and cloud services, their attack surface expands. Risk platforms must integrate with these ecosystems to surface real-time insights and automate mitigation.

- Efficiency under constraint: Even as risks grow more complex, budgets and teams aren’t keeping pace. Buyers need automation that scales expertise, streamlines treatment, and reduces redundant effort.

- Executive and board accountability: Boards expect timely, defensible risk reporting. Modern platforms deliver real-time dashboards, audit-ready evidence, and metrics that tie risk reduction directly to business outcomes.

How we picked these tools

Today’s tools must go beyond logging risks to automate evidence collection, connect to live control tests, and provide a single source of truth for stakeholders. As teams move from reactive reviews to continuous monitoring, the best platforms balance automation, flexibility, and scalability—turning risk tracking into true operational resilience.

To identify the top risk management platforms, we evaluated vendors against ten key criteria that define a modern program:

Disclaimer: To help you find the best risk management software, we’ve researched and ranked a selection of leading platforms. While we may be biased about Vanta being the top option, we aim to provide a comprehensive view so you can choose the right fit for your organization.

Best risk management platforms

Here are our top picks and a comprehensive breakdown of their features, pros and cons to help you choose the right fit for your organization.

#1 Vanta

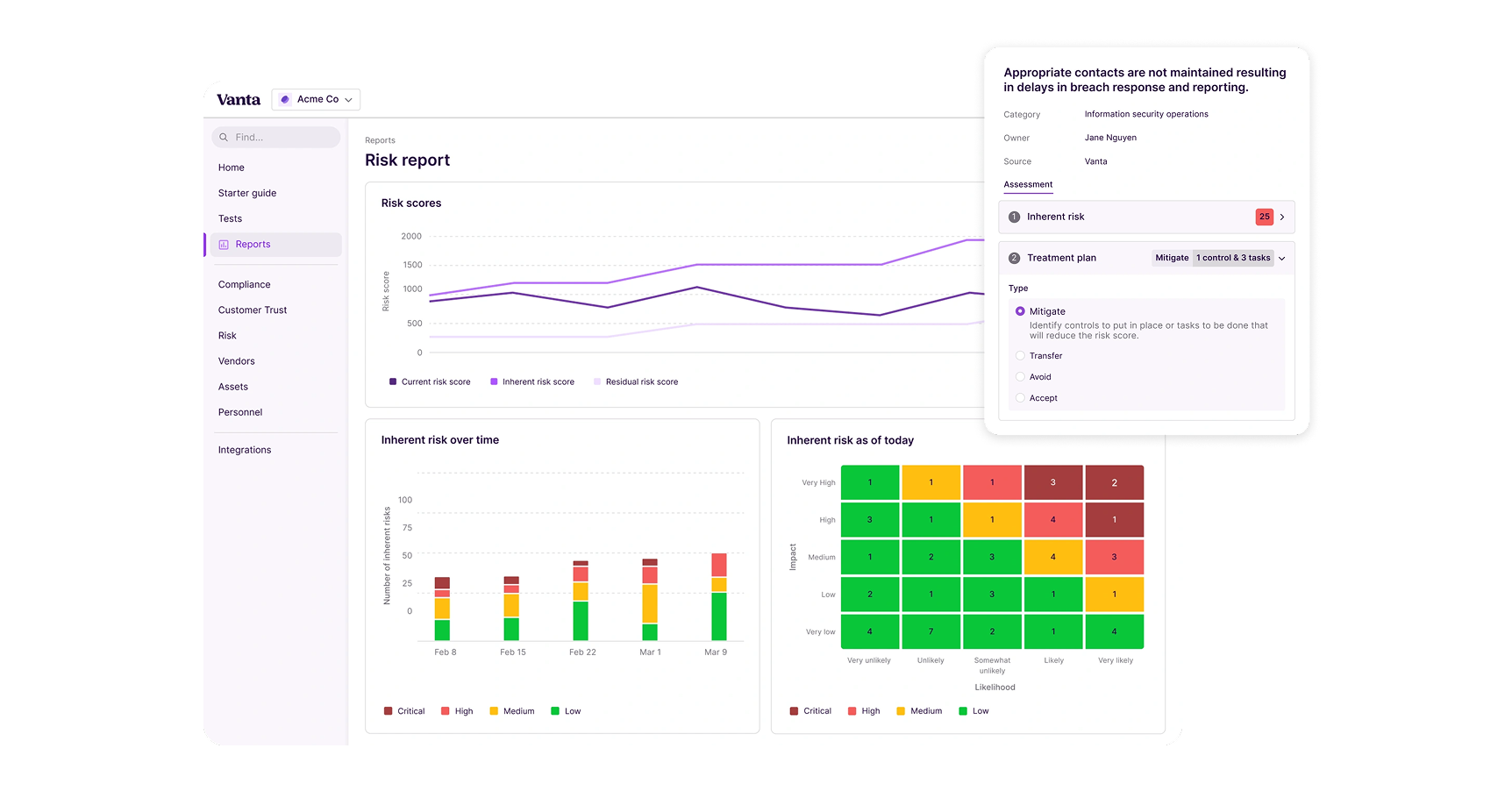

Vanta turns risk from a static spreadsheet into a living program. It ties your risk register to continuously tested controls, vendor monitoring, and automated reporting—ensuring decisions stick.

Vanta’s AI-powered workflows consolidate risks across teams, while its new vendor monitoring connects internal and third-party data for a unified, real-time view. Reporting stays board-ready with snapshots, exports, and auditor collaboration tools—no screenshots or back-and-forths required.

Ideal for: Fast-growing companies and enterprises that want modern, continuous risk management with unified vendor visibility—or startups building a scalable GRC foundation.

Key features

- Continuous risk monitoring: Gain continuous insight into the controls and tests associated with a risk, with immediate notification when a test fails.

- Risk snapshots: Take a moment-in-time snapshot of your risk register to be shared with auditors or downloaded.

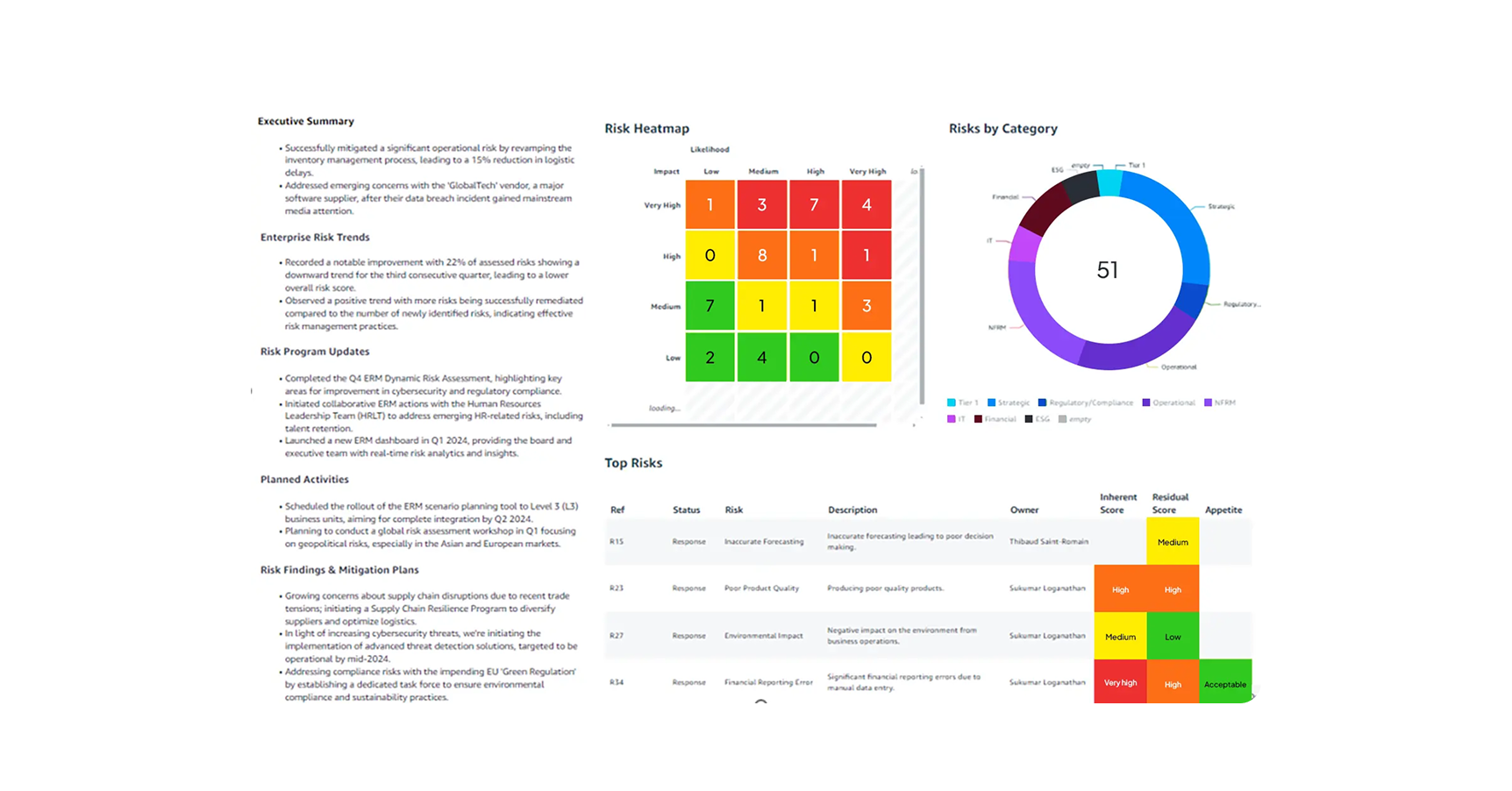

- Risk reporting: Get up to speed fast with your risk report. View your risk heatmap, top risk categories, and risk trends over time, and easily share program status with stakeholders.

- Vendor risk: Tie your overall risk management program to vendor risk management by linking findings added during a vendor security review to risk scenarios.

- Risk library: Jumpstart your program with a built-in library of common risk scenarios (100+ scenarios), each with suggested mitigating controls you can link to quickly.

- Multiple risk registers: Create multiple risk registers tailored to each business function—like finance, legal, IT, and more—so teams own and manage what's in their domain, while risks are measured in a standardized, consistent way across the business.

- Flexible scoring and custom fields: Align to your preferred methodology with configurable likelihood/impact scales, categories, CIA tags, and custom attributes to capture the context auditors care about.

- Approval workflows and recurring reviews: Route scenarios through configurable approver(s), capture approval history, and schedule recurring reviews to keep your register current.

{{cta_simple28="/cta-blocks"}}

#2 AuditBoard

AuditBoard’s connected risk platform unifies audit, risk, and compliance with a single register, RCSAs, dashboards, and AI‑assisted content to drive decisions. ERM, ITRM, and TPRM sit side‑by‑side for shared context and reporting.

Ideal for. Teams standardizing on a “connected risk” operating model across audit, compliance, and IT risk with strong stakeholder alignment.

Key features

- Risk register: Single, connected register to view org‑wide risks and standardize language

- Self‑assessments: Risk and control self‑assessments to scale ERM participation

- AI capabilities: AI‑powered content to accelerate assessments and documentation

- Vendor management: Third‑party risk module to visualize, assess, and mitigate vendor risk

- IT risk management: IT risk management to prioritize, monitor, and quantify tech risk

- Reporting: Customizable dashboards and platform reporting

- Integrations: Integrations and APIs for data collection and workflows

#3 Hyperproof

Hyperproof emphasizes program scalability with an extensive frameworks library and integrations that sync tasks and evidence from systems like Jira, Asana, and ServiceNow. Its TPRM workflows centralize questionnaires, findings, and residual risk tracking.

Ideal for. GRC teams prioritizing framework coverage and collaboration across engineering and operations via synced tasks and evidence.

Key features

- Template options: Library of 118+ framework templates, customizable to your program

- Evidence automation: Hypersyncs/LiveSync to pull evidence and mirror tasks from Jira/Asana/ServiceNow

- Third-party risk management: Vendor inventory, tiering, questionnaires, and residual risk reporting

- Program management: Centralized evidence with reminders and audit trails

- Vendor updates: Reporting on vendor status, outstanding actions, and reassessment cadence

- Collaboration tools: Collaboration via integrations (Slack, Teams, email) to keep owners on task

- Continuous monitoring: CCM guidance to automate ongoing control checks where feasible

#4 Diligent

Diligent One brings enterprise risk management, audit, compliance, and third-party risk management into a single, AI‑powered platform, with risk intelligence, dashboards, and connected workflows for boards and operators alike.

Ideal for. Organizations aligning GRC to board priorities and scaling VRM/ERM with AI‑assisted insights and reporting.

Key features

- Enterprise capabilities: ERM with risk intelligence, dashboards, and reporting

- Vendor risk: Third‑party risk management with centralized workflows and monitoring guidance

- Integrations: Connected risk platform spanning audit, compliance, and ITRM

- Framework mapping: Framework and regulatory alignment across programs

- Reporting: Analytics and dashboards for executive/board reporting

- Scalable VRM: Content and resources for VRM maturity and processes

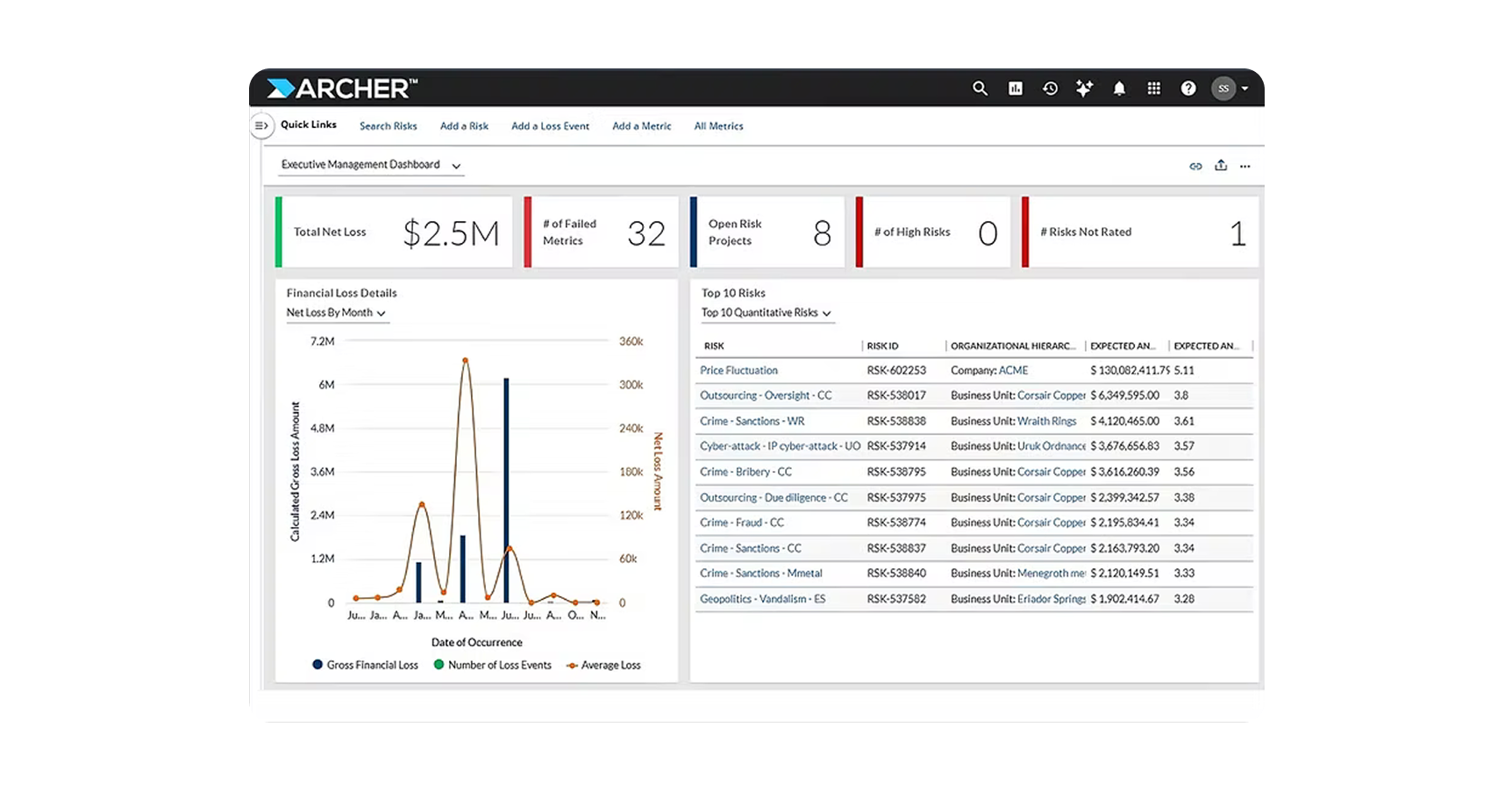

#5 Archer

Archer pairs mature IRM modules (ERM, ITRM, TPRM, Resilience) with Archer Insight for quantitative risk analytics, moving beyond heat maps to money‑based prioritization. Its next‑gen UI and AI workflows emphasize accessibility and integrated decisions.

Ideal for. Enterprises upgrading from qualitative matrices to quantification while standardizing ERM/TPRM/ITRM on a single IRM platform.

Key features

- Financial impact analysis: Archer Insight risk quantification to prioritize by financial impact

- Enterprise risk management: Enterprise and operational risk management modules to standardize risk management across the organization, track KRIs and establish accountability with root cause analysis and loss event management

- IT and security resilience: IT and security risk management and ensure business resilience against cyber attacks, natural events and more

- Third-party risk management: Vendor governance for external partnerships and discovery, assessments of vendor risks

- AI-optimized risk workflows: Next Generation Risk Experience with AI-driven automation

- Scalable architecture: Open APIs and microservices for flexibility and growth

- Value-driven reporting: Transforming ERM into a strategic value center

How to choose the right risk management software

Choosing the right platform comes down to aligning capabilities with your operating model, risk appetite, and scale. Here’s how to approach the selection process:

- Start with your pain points: Identify challenges like stale registers, siloed ownership, or slow remediation. Define measurable outcomes such as reduced exception volume or faster time-to-mitigation.

- Define decision criteria: Prioritize automation depth, continuous monitoring, methodology flexibility, third-party risk coverage, and reporting strength.

- Map your stack and data flows: Assess integrations across cloud, identity, endpoints, code, and HRIS systems to eliminate manual uploads and blind spots.

- Validate automation coverage: Trace each control or risk signal to its source, verifying frequency and accuracy.

- Assess workflows and governance: Test intake, approval, and exception lifecycles to ensure auditable, repeatable risk reduction.

- Model scale and total cost of ownership: Project data growth and user volume, and validate pricing transparency and implementation effort.

Ready to operationalize risk with Vanta?

Risk software should make risks visible, accountable, and actionable—continuously. With Vanta, you can connect risks to live control tests, streamline treatment and exceptions, and add continuous vendor monitoring to stay ahead of change. See how it fits your program with a quick demo.

{{cta_simple28="/cta-blocks"}}

Risk management software FAQs

What is risk management software?

Risk management software centralizes the risk lifecycle—from intake and scoring to treatment, exceptions, and reporting. It connects to your tech stack to automate evidence, maintains audit trails, and delivers dashboards that align executives, owners, and auditors around prioritized risk reduction.

How does continuous monitoring differ from point‑in‑time reviews?

Continuous monitoring ingests fresh signals from connected systems and vendor feeds to detect drift and changes between assessments. Rather than waiting for quarterly reviews, it flags issues in near‑real time, enabling faster triage, remediation, and more reliable reporting.

Which risk methodologies should a platform support?

Look for flexibility to run qualitative matrices and support ISO 27005 or NIST SP 800‑30, with optional quantitative approaches like FAIR. As programs mature, you’ll want configurable scales, weights, and versioning that preserve historical trendlines across methodology changes.

How should it handle third‑party and vendor risk?

A modern platform supports intake and tiering, questionnaires and evidence reviews, continuous outside‑in monitoring, findings workflows, and remediation tracking. It should link vendor findings to your register, owners, and SLAs, and surface alerts relevant to business‑critical suppliers.

Why do integrations matter so much?

Integrations eliminate manual uploads, reduce evidence gaps, and keep the register current. Strong coverage across cloud, identity, code, endpoints, assets, HRIS, and ticketing enables reliable automation, richer analytics, and fewer surprises during audits or executive reviews.

What metrics indicate a healthy risk program?

Track risk aging and time‑to‑mitigation, exception volume and expirations, residual versus inherent risk trends, control drift rates, vendor finding resolution times, and ownership responsiveness. Pair operational metrics with outcome measures like incident reduction and audit efficiency.

FEATURED VANTA RESOURCE

The ultimate guide to scaling your compliance program

Learn how to scale, manage, and optimize alongside your business goals.

.webp)

.svg)

.svg)